A Facebook post attributed to Jayne’s Baby Bank states:

“Saturday & Sunday Volunteers: £40 store credit 9am–5pm (8-hour shift), £50 store credit 5pm–10pm, free micro meal and snacks and drinks.”

Other promotional posts mention volunteer shifts offering £20 or £25 in store credit for shorter hours or weekday assistance. While framed as “volunteer” roles, this type of structured and repeatable reward system raises important questions under UK employment and benefit law.

Volunteering vs. Employment Under UK Law

UK legislation and guidance make it clear that volunteers:

- must not receive payment or benefits beyond reimbursement of genuine out-of-pocket expenses (e.g. travel, meals, equipment)

- should not receive fixed-value incentives like vouchers, store credit, or cash-like rewards

According to GOV.UK and HMRC guidance, offering structured or guaranteed perks — including store credit of £20–£50 — may legally reclassify a “volunteer” as a worker. If so, this can trigger legal entitlements such as:

- National Minimum Wage (NMW)

- Holiday pay and rest breaks

- National Insurance and employer tax contributions

This principle is reinforced by employment lawyers at Tozers LLP and confirmed in multiple employment law cases.

Risks for Volunteers on Benefits

UK residents claiming Universal Credit, ESA, or similar support must report all volunteering to the Department for Work and Pensions (DWP) — including hours, duties, and any perks received.

Per Low Incomes Tax Reform Group (LITRG), receiving structured or regular store credit can be treated as notional income, potentially resulting in:

- Reduced benefit entitlement

- Sanctions or overpayment recoveries

- Loss of support for disabled volunteers or carers

This is particularly important for those on means-tested benefits, where store credit could be interpreted as undeclared remuneration.

Problematic “Goodwill” Claims

Two separate public statements have attempted to justify the practice by stating:

“Paid in stock and it won’t affect benefits/HMRC/tax credits as it is a gesture of goodwill from myself.”

“This is declared to HMRC and DWP as a gesture of goodwill. This should not affect your tax or benefits.”

These justifications do not alter the legal position. Under HMRC rules:

- Calling something “goodwill” does not override legal classification — if it looks like payment and functions like payment, it will likely be treated as such.

- Declarations to HMRC or DWP must be backed by formal reporting, accounting records, and tax compliance. A personal claim alone does not constitute compliance.

- Regular, structured compensation — including store credit — can invalidate volunteer status under employment law.

Charity Status & Branding Concerns

Jayne’s Baby Bank is not listed on the Charity Commission register (source), and previous investigations suggest that registration efforts have been declined or withdrawn due to compliance issues (report).

Despite this, branding and signage have previously referenced “charity shop” status — which may cause confusion for the public and regulators. For a breakdown of the legal distinction, see: Understanding the Difference Between Charity Shops & Registered Charities.

Legal Warnings from Experts & Forums

“If you pay any money or give a voucher to a volunteer, you risk them being classed as a worker and owed at least minimum wage.” — LegalAdviceUK

“Systematically compensating volunteers for their work generally makes them employees under UK law.” — LegalAdviceUK Community

These community insights echo formal legal and governmental advice. If a volunteer is expected to work set hours, receive regular perks, and perform core operational tasks — they are likely not a “volunteer” under UK law.

Conclusion: Legal Grey Area with Real-World Risks

The current volunteer arrangements promoted by Jayne’s Baby Bank raise several legal questions:

- Offering £20–£50 in store credit per shift may constitute worker payment

- This could create employment law obligations — including minimum wage and tax requirements

- Unregistered charity status complicates public accountability

- Benefit claimants may be unintentionally exposed to DWP sanctions

Volunteering is essential to many community causes — but it must be handled lawfully, transparently, and in a way that protects both the public and those involved. Failure to do so risks not only legal consequences, but harm to vulnerable participants and confusion among donors.

Explore further via our transcript archive.

Sherlock

📄 Key Documents and Reference Material

FOI Correspondence: https://jaynesbabybank.co.uk/wp-content/uploads/2025/08/Correspondance_redacted.pdf

Declared Operator Type (Registration Form): https://jaynesbabybank.co.uk/wp-content/uploads/2025/08/Reg-form_redacted.pdf

Facebook Page: https://www.facebook.com/jaynesbabybankvolunteershealthandsafetypage/

Documentation submitted to Caerphilly County Borough Council (CCBC) explicitly references the above Facebook page in relation to training procedures and volunteer coordination. The page itself repeatedly promotes discounts, offers, and other forms of public engagement by invoking the language of charitable work.

The internal form submitted alongside this material includes the designation:

Operator type | A charity

This labelling appears inconsistent with the legal status of Jayne’s Baby Bank, which is not a registered charity in England or Wales according to the Charity Commission database.

The repeated public and internal use of the term “charity” without registration suggests a pattern of behaviour aimed at presenting the organisation as a legitimate charitable entity—despite lacking the legal recognition required to do so. This raises clear concerns regarding misrepresentation, particularly where public trust and volunteer involvement are solicited on the basis of charitable claims.

—Sherlock

I feel extremely sorry for anyone who has been deceived by her and her grunt of a son, imagine working for her, busting your guts for hours and hours, and your reward is farcical “training ” illiterate and inept “experience” and “store credit” ! Wow gee thanks for my bag of cruddy dirty clothes! I’m so greatful that you fully appreciate my innocent attempts to assist the community, Carrie Anne Ridsdale Jayne Price or any other combination of assimultwd names to secure tenancies by ilegal means, and don’t worry about my exploitation of single mothers and other vulnerable members of our communities, and certainly don’t fret about my benefits being affected. I am the master manipulater and font of all half knowledge, untruths, deception, misrepresentation, corruption, and lies. Don’t worry about my clearly narcissistic approach, and please do ignore my passive aggressive, bullying micro management, and ludicrous empire building, for I Jayne Price am the greatest cad, in the world, I will continue to heap my rubbish to the greatest heights of machu picchu, and there upon will be gilded golden graven image of myself, all will bow down and worship at the alter of ME !

And strewn before me will be the dank offerings of gone off gesture baby milk, ( you know to make it look like a baby bank …ish but really this entire enterprise is just an extension of grotbag home, in a cul de sac in pontlanfraith because the vans and weeds metal and Junk I have acrewed acquired stolen and pillaged has exuded my perimeters, and I have pissed the neighbours off)

And there before me will be wailing and gnashing of teeth, as I feast upon the misfortunes of others, your suffering is my gain! FOR I AM THE GOLDEN GOD OF JUNK AND I SHALL CONQUER THE WORLD ALL WILL BOW DOWN AND WORSHIP ME ! AND IF YOU GET MY NAME WRONG TODAY I SHALL SMITE THEE WITH MY POT NOODLE!

It’s the only way to express my anger and sense of injustice! My true emotions are far more severe, I’m sitting back and waiting for her. Tick tock ….

AUTOMATED LIVE VIDEO NOTIFICATION

SOURCE: https://www.facebook.com/100083342834915/videos/774371674948071

The video above contains multiple false and misleading claims regarding volunteering, benefit compliance, and payment practices. Each of the following statements requires correction:

❌ CLAIM: “Allowance for volunteers is permitted”

False. Under UK employment law, volunteers may only be reimbursed for actual, evidenced out-of-pocket expenses (e.g. travel receipts).

Offering fixed-rate “allowances” or “store credit” — such as £20–£50 — is not reimbursement. It is legally treated as wages or benefits in kind.

Regular payments of this nature are likely to classify the recipient as a “worker” under the law — triggering obligations including minimum wage, tax, and NI contributions.

❌ CLAIM: “DWP and Jobcentres support this arrangement”

Misrepresentation. The Department for Work and Pensions (DWP) requires all claimants to declare any benefit received — including cash, store credit, or vouchers.

Declaring hours in a Universal Credit (UC) journal does not make a payment scheme lawful.

Store credit is treated as “notional income”, and can lead to deductions or suspension of benefits.

No DWP or Jobcentre officer has the authority to “approve” a scheme that contradicts national benefit and employment law.

❌ CLAIM: “Recorded in job diaries = approved volunteering”

Misleading. Claimants may record voluntary work in their UC journals. However:

This does not override employment classification rules.

If someone receives store credit or material rewards, they risk being legally classified as a “worker”, not a volunteer — and would be entitled to the National Minimum Wage, holiday pay, and other rights.

❌ CLAIM: “HMRC/PIP will become familiar with it and stop investigating”

Factually incorrect. Familiarity with a name does not prevent investigation or enforcement.

HMRC defines non-expense payments (like store credit or vouchers) as earnings.

PIP, DWP, and HMRC all consider such payments to be income — regardless of frequency or label.

This false claim may mislead vulnerable individuals into unknowingly breaching benefit rules.

🚨 DELIBERATE MISREPRESENTATION

TRANSCRIPT EXCERPT:

BEGIN QUOTE:::

“That if they are volunteering, they’re volunteering for us. And it’s been a named volunteer… By putting our name on it… The more and more it gets tagged… The more and more that places like PIP, HMRC… it will become more familiar to them.”

:::END QUOTE

This is not compliance — it’s a deliberate tactic to:

Insert the organisation’s name into DWP systems via claimants’ UC journals;

Create the illusion of official recognition through repetition.

This approach is legally and ethically dangerous. Repeated tagging could in fact strengthen HMRC or DWP evidence of systematic disguised employment, not legitimise it.

⚠️ CLAIM: “Good news — Jobcentres want volunteers”

Partially true — but irrelevant.

Yes, Jobcentres encourage genuine volunteering. But this scheme is not volunteering. Offering fixed-value “rewards” for labour renders the relationship contractual — meaning the role meets the legal definition of work.

This exposes both the operator and participants to serious legal and financial risk.

🔍 CONCLUSION

The scheme described in this video amounts to deliberate misrepresentation:

Store credit is not an “allowance” — it is income.

Naming the organisation in job diaries does not confer approval.

Encouraging repetition to feign legitimacy is a calculated strategy to avoid legal obligations.

This model places benefit claimants, particularly disabled or vulnerable individuals, at risk of:

Sanctions,

Overpayment demands,

Or loss of entitlement.

Meanwhile, the operator avoids employer responsibilities such as payroll, NI, tax, and employment protections.

What is presented as “volunteering” is, in legal terms, a scheme of unlawful, disguised employment — dressed up for legitimacy, but structurally and ethically flawed.

– Sherlock

SOURCE: https://www.facebook.com/story.php?story_fbid=576947595093330&id=100083342834915

BEGIN QUOTE:::

✅️We work wirh ACAS so volunteers with disabilities and learning difficulties can access work related training and courses and equiptment to help them volunteer.

:::END QUOTE

ANALYSIS:

Carrie-Anne Ridsdale, operating under the name Jayne Price, has publicly claimed that Jayne’s Baby Bank “works with ACAS” to support volunteers with disabilities and learning difficulties.

This claim is categorically false.

We contacted ACAS (Advisory, Conciliation and Arbitration Service) directly. Their formal response confirms:

“Acas has no affiliation with ‘Jaynes Baby Bank’.”

SOURCE: https://jaynesbabybank.co.uk/wp-content/uploads/2025/08/ACAS.png

Furthermore, the matter has now been referred internally to ACAS’s relevant investigations department, suggesting that the use of their name in this context may warrant further review.

CONCLUSION:

This appears to be another example of a misrepresentation of associations with reputable organisations, potentially to create a false impression of credibility or compliance.

When public bodies are falsely named as partners, it not only misleads the public, but may also trigger reputational and legal consequences for the claimant.

– Sherlock

SOURCE:

📌 Facebook Post: https://www.facebook.com/story.php?story_fbid=748133481308073&id=100083342834915

“MASSIVE THANK YOU TO THE DWP AND HMRC FOR SUPPORTING MYSELF AND VOLUNTEERS WITH THIS.”

This public statement formed part of the video content shared on the same date.

We’ve reviewed the claim, associated transcript, and applicable UK law. The statement appears to misrepresent the nature of volunteering, mislead vulnerable benefit claimants, and contradict multiple sources of published government guidance.

🔍 ANALYSIS

1. Misclassification as “volunteers”

If individuals are expected to:

Work set shifts (e.g. 9–5),

Perform tasks to receive an “allowance” or discount, and

Adhere to a set of rules under the direction of another person,

Then by legal standards, this resembles employment, not volunteering.

Under the Employment Rights Act 1996, key indicators of worker status include personal service, mutual obligation, and control. Workers are entitled to National Minimum Wage, holiday pay, pension contributions, and other protections.

🔗 SOURCE: https://www.gov.uk/government/publications/employment-status-and-employment-rights/employment-status-and-rights-support-for-individuals

🔗 SOURCE: https://www.acas.org.uk/employment-status

🔗 SOURCE: https://commonslibrary.parliament.uk/research-briefings/cbp-8045/

2. Allowances treated as payment

Calling something a “gesture” or “goodwill allowance” does not change its legal status.

Regular, fixed-value perks — such as store credit, discounts, or vouchers — are treated as benefits in kind or income, and may be subject to tax, NI, and employment law.

🔗 SOURCE: https://www.litrg.org.uk/employers/payments-volunteers

3. Misleading about benefits & Jobcentre “agreement”

Telling benefit claimants that an arrangement is “approved” or “won’t affect their benefits” is dangerously misleading.

The DWP explicitly states that all payments or perks — including store credit, free meals, or discounts — must be declared.

Failing to do so can result in:

Deductions,

Overpayment recovery,

Sanctions,

Or even fraud investigations.

Statements such as “the Jobcentre has agreed” are inaccurate.

Any such agreement must be made individually and in writing with a Work Coach. There is no general or group approval process.

🔗 SOURCE: https://www.gov.uk/volunteering/pay-and-expenses

🔗 SOURCE: https://www.volunteernow.co.uk/app/uploads/2022/05/Volunteers-Expenses-Information-Sheet-1-2.pdf

🔗 SOURCE: https://www.gov.uk/universal-credit/how-your-earnings-affect-your-payments

4. Unclear or discriminatory language

Saying flexibility only applies to “mothers with children under 18” may constitute indirect discrimination under the Equality Act 2010.

All roles must accommodate reasonable adjustments and not apply arbitrary exclusions.

🔗 SOURCE: https://www.equalityhumanrights.com/en/advice-and-guidance/flexible-working

5. Withholding perks shows payment in exchange for work

Statements suggesting that only those who complete full shifts receive perks or discounts imply a quid pro quo arrangement — again pointing toward worker status, not volunteering.

🔗 SOURCE: https://www.acas.org.uk/employment-status

6. Invented terms like “flexi vol”

The label “flexi volunteer” does not exist in UK employment law. Creating new job titles does not override employment rights.

What matters legally is how the role operates in practice — not what it is called.

🔗 SOURCE: https://www.gov.uk/employment-status

7. Knowing the risk but continuing anyway

The transcript includes an apparent admission that legal advice would warn against offering perks based on shift work — yet the scheme proceeds regardless:

“Any lawyer would say don’t pay £20 or give 75% off unless they’re doing a full shift.”

Knowingly continuing such a practice shows awareness of potential non-compliance — and disregard for the legal implications.

🔗 SOURCE: https://commonslibrary.parliament.uk/research-briefings/cbp-8045/

📄 FULL TRANSCRIPT:

https://jaynesbabybank.co.uk/search/?search=%22Job+Centre+has+agreed%22&limit=50&sort_order=relevance&search_type=all&open_transcript=20250818_550087878131014.txt

📝 CURRENT STATUS:

We have contacted both the DWP and HMRC to verify the claim of official support.

Updates will be provided once we receive a response — whether confirming or refuting the statements made in the video.

At present, the evidence strongly suggests that these public claims:

Misrepresent legal definitions of volunteering,

Mislead benefit claimants,

And risk exposing vulnerable individuals to significant financial and legal consequences.

– Sherlock

She is misleading everyone again! Is this the same way that she ‘passed’ all the complaints made against her by the Fire Service, Environmental Health, Trading Standards etc. As you say Sherlock each individual volunteer will have to be assessed by the DWP not just take this pathological liars word. You proved that all her statements regarding passing all her investigations by various agencies were completely false!

She has seen and heard a lot of things about the whole scandal now though. She’s choosing not to believe the publics concerns. She’s seen how Carrie-Anne treats people, she saw Carrie-Anne assault a member of the public when approached. Yet she’s still encouraging mothers to use the services and taken on a management role. She is also accountable for anything that happens at the shops she is in charge of. Whether Carrie-Anne allows her to look at the website or not she can’t control that. She wouldn’t even know. Who wouldn’t look. If she’s still turning a blind eye after all that she has witnessed and all the evidence presented it’s probably because she’s benefitting far more.

A scandal as big as normally involves multiple people.

https://www.facebook.com/story.php?story_fbid=744326895022065&id=100083342834915

Your statement misrepresents UK law on volunteering and “gestures of goodwill.”

Under UK law, regular, fixed-value rewards (including store credit, vouchers, or gift cards) are not treated as harmless goodwill — they are considered payment if they exceed genuine out-of-pocket expenses. HMRC’s own National Minimum Wage Manual and GOV.UK guidance make this clear.

The key points are:

– Regularity & value matter: A “gesture” that happens every shift and is worth £20–£50 is not a token of appreciation; it’s a systematic reward for labour. That legally risks reclassifying someone as a worker, triggering minimum wage, holiday pay, and employer tax/NIC obligations.

– DWP & HMRC notification doesn’t make it legal: Informing these bodies does not override employment law. If the arrangement meets the definition of “work,” it will still be treated as such for tax, NI, and benefits purposes.

– Benefit risks: For people on Universal Credit, ESA, or similar, store credit of that value can be treated as earnings, reducing or removing benefit entitlement. This is why official advice to volunteers warns against accepting regular non-expense rewards.

– True goodwill gifts are occasional, low-value, and unexpected — not guaranteed every shift. The arrangement you’re describing clearly doesn’t meet that test.

– Tempo Time Credits Cymru are a separate, regulated community currency with specific legal frameworks — they’re not comparable to an employer or shop issuing its own store credit as payment.

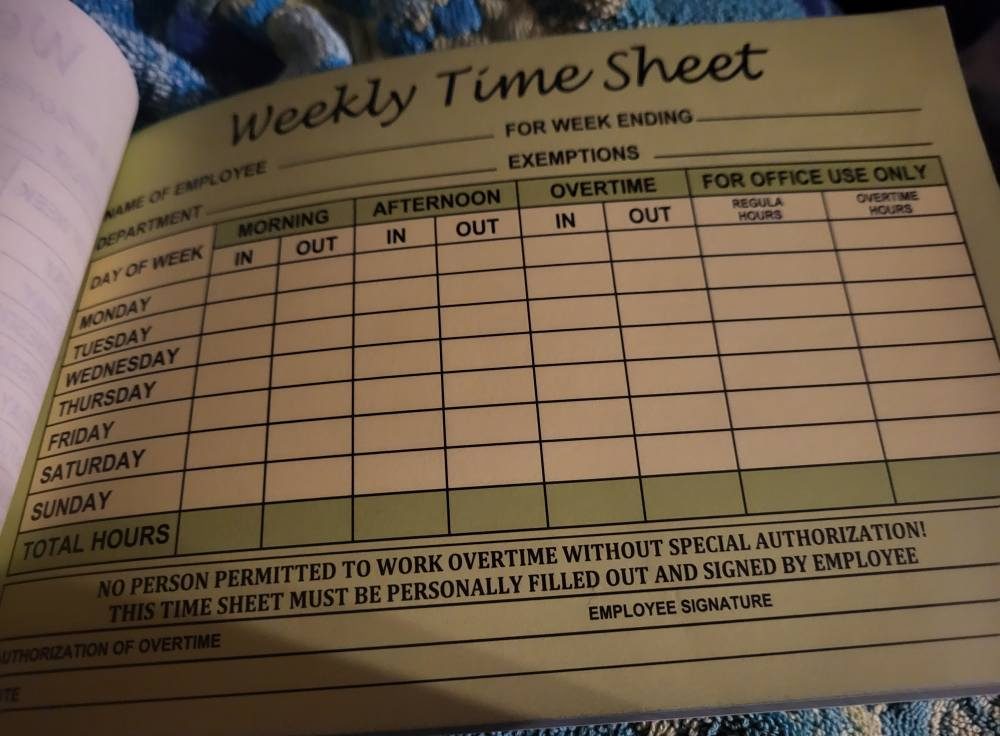

Calling something “goodwill” doesn’t change the legal reality. If it walks, talks, and quacks like payment for work, UK law will treat it as payment. You are risking the livelihoods of those you mislead, and worst of all, you publicly shared a timesheet referring to an “employee signature.” Using a timesheet — a tool for recording work hours — and explicitly labelling someone an “employee” directly undermines your claim of goodwill volunteering, strengthening the case that these individuals are legally workers owed minimum wage and other protections.

Sherlock

So technically she is putting all her staff at risk of losing their benefits! But I dare say she will say this is all nonsense but she needs to read up on this, as I did, and she is definitely in the wrong telling them that they are entitled to take stock as payment. Unfortunately she forbids her ‘staff’ to read this website so sadly they are all unaware that they are all at risk of losing their benefits.

https://www.southwalesargus.co.uk/news/25226904.jaynes-baby-bank-helped-struggling-pontypool-mum/

Samantha had the following to say to anyone struggling.

“Pop in. “We are all mums. We’ve all needed help one way or another. We also support anyone with learning difficulties. You’re welcome to volunteer with us.

“We need a wider range of wider volunteers here.

“If you do up to eight hours you get a £20 stock allowance and it’s a great help.”

Jayne’s Baby Bank has shops in Pontypool, Risca Caerphilly and Blackwood. The business is currently looking for volunteers.

Sherlock.

Samantha needs to be report to the DWP. She’s clearly on benefits yet very able to go out to work.

I feel Samantha may be caught up in something she isn’t fully aware of. I truly believe she has the very best interests of mothers and families at heart. However, she also holds a managerial role, overseeing the upkeep of one shop and one Vinted store.

If Carrie were to allow Sam to read this website, I imagine she would have questions — and those questions could cause difficulties. It’s worth remembering that, in a previous video where a member of the public confronted Carrie, Sam was present and appeared genuinely concerned about what might unfold. She seemed, at the time, unaware of the full reality of the situation — namely, that her employer is a known fraudster with a record of illicit behaviour.

S

She states in one of her ramblings that one of her volunteers has commented on here. I can’t remember if she named Sammy or if I assumed it was her.