Registered Details and Structure

According to the certificate of incorporation, the company is situated in Wales and falls under SIC code 96090 — “Other service activities not elsewhere classified.” This broad classification allows flexibility for community-based projects, though it does not itself confer charitable or regulatory status.

The founding documents also include a Statement of Guarantee showing Price, Jenkins, and Ridsdale each pledging £1, standard for CICs. However, Jayne Price retains overall control and decision-making authority through her status as majority guarantor and PSC.

Identity and Email Link

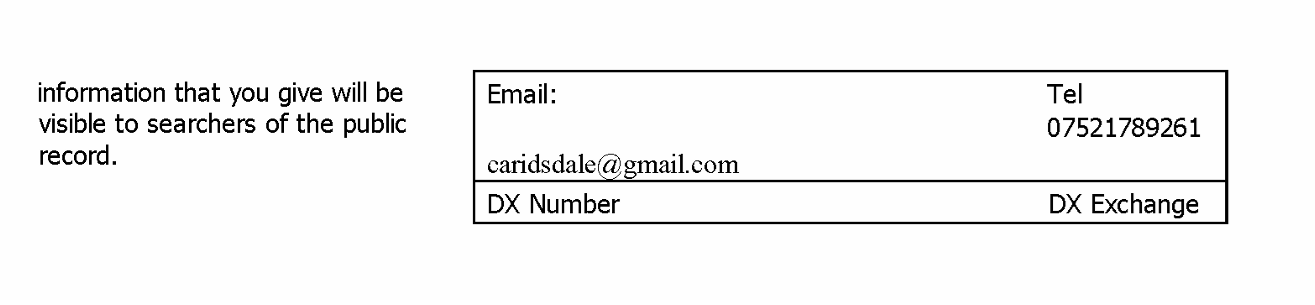

While publicly identifying as Jayne Price, the director has been historically associated with the email address carridsdale@gmail.com — incorporating the name Carrie-Anne Ridsdale, which she has publicly denied using. Nevertheless, incorporation records list Daniel-James Ridsdale at the same address, reinforcing documentary links between the Price and Ridsdale identities across multiple filings.

This overlap mirrors previous records where the same individuals have appeared interchangeably under the Ridsdale and Price surnames across tenancy, donation, and social media materials connected to Jayne’s Baby Bank. The inclusion of the Ridsdale name in an official company document, therefore, provides the first direct legal confirmation of the association.

From Unregistered Operation to Registered CIC

Prior to incorporation, the Jayne’s Baby Bank name operated informally across South Wales, presenting itself as a “charity shop” or “baby bank” while remaining absent from the Charity Commission register. Establishing the organisation as a CIC may represent an attempt to formalise those activities under the Companies Act 2006 while avoiding the more stringent oversight and transparency obligations that apply to registered charities.

Under UK law, Community Interest Companies must operate for social benefit and file an annual Community Interest Statement explaining how their activities serve the public good. Failure to maintain transparency or misuse of the CIC structure for private gain may lead to intervention by the Office of the Regulator of Community Interest Companies.

Directors and Guarantors

- Miss Jayne Price — Director, Person with Significant Control, Welsh national, occupation listed as Company Director.

- Mrs Gail Jenkins — Director, Welsh national, resident of Woodfieldside, Blackwood.

- Mr Daniel-James Ridsdale — Guarantor, address shared with Price at 7 Meadow Road.

All three provided authentication during the electronic filing, confirming awareness and consent under the Companies Act 2006.

Community Benefit and Oversight

As of publication, Jayne’s Baby Bank C.I.C. has not yet published a formal Community Interest Statement outlining its objectives or funding model. The absence of such detail leaves open questions about how the CIC intends to differ from the prior unregistered operations that previously faced scrutiny over transparency, data handling, and financial accountability.

Public oversight of Community Interest Companies is conducted by the CIC Regulator, based in Cardiff. Members of the public can verify filings, officers, and control statements via the official Companies House register.

Legal and Financial Reporting Obligations

Under the Companies (Audit, Investigations and Community Enterprise) Act 2004 and the Community Interest Company Regulations 2005, all CICs must meet ongoing statutory obligations to ensure accountability and prevent misuse of public funds. These include:

- Annual Accounts: Every CIC must submit annual accounts to Companies House within nine months of the financial year-end. Accounts must include a balance sheet, income statement, and explanatory notes.

- CIC Annual Report: A separate annual report to the CIC Regulator must explain how the company’s activities benefited the community, how any surpluses were used, and any dividends or payments to directors. This report is made publicly available.

- Asset Lock: All CICs are legally bound by an asset lock, meaning profits and assets must be used for the community benefit rather than private enrichment. Transfers must be approved by the Regulator.

- Financial Transparency: Where income exceeds £10,200, detailed financial disclosures are mandatory. If turnover surpasses £632,000 or assets exceed £316,000, an audit by a registered accountant is required.

- Public Access to Records: Members of the public have the right to inspect filed accounts, annual reports, and officer details via the Companies House service, ensuring transparency of all community-interest activities.

- Prohibited Misrepresentation: A CIC must not present itself as a registered charity unless it has obtained separate charitable status and Charity Commission registration. Doing so risks breach of the Charities Act 2011 and the Consumer Protection from Unfair Trading Regulations 2008.

Unlike a registered charity, a CIC does not qualify for Gift Aid or charitable tax exemptions and must operate under general company law. It is required to demonstrate community benefit through its operations and proper financial stewardship each year.

Identity Verification and False Declaration Risk

As of late 2025, Companies House does not yet require photographic identification to be verified at the time of incorporation. Applicants simply self-certify their details. However, providing false or misleading information is a criminal offence under section 1112 of the Companies Act 2006.

The Economic Crime and Corporate Transparency Act 2023 introduces new legal duties for ID verification. Once implemented (expected during 2025–2026), every director and person with significant control must have their identity verified either directly with Companies House or via an authorised agent. Incorporations submitted under false names after enforcement begins will be automatically invalidated and subject to criminal sanction.

Summary

The creation of Jayne’s Baby Bank C.I.C. marks the first formal registration of the name after years of informal use. While incorporation as a Community Interest Company can lend legitimacy to social initiatives, the accompanying records reaffirm longstanding connections between Jayne Price and the Ridsdale identity she has publicly disputed. The development represents both an administrative milestone and a potential continuation of a complex history surrounding the project’s true ownership and accountability.

For the public record, this article interprets data filed with Companies House and verified through official documentation. No allegations of wrongdoing are implied beyond the factual scope of the filings.

Disclaimer: This article references public company-registration data under the Companies Act 2006 and CIC Regulations 2005. It is for informational purposes only and does not constitute legal advice.

— Sherlock

https://propertyauctions.io/listings/bf1082224613a350a2658b4ca1127ede

“The property is a commercial retail investment comprising basement, ground, and first floors, with a total size of 1,980 square feet (183.94 square meters). It is currently let to a tenant trading as Jayne’s Baby Bank, with a lease that commenced in January 2023 for a term of three years, expiring on January 16, 2026. The property is located on a principal retail street in Pontypool, near local shops and an indoor market. The annual rent is £4,800.”

Rent overdue? Time to expand!

PS: Publicly available listings and photographic evidence dated February 2024 show the premises being advertised as a “Charity Shop” via window signage and pavement signage, despite the operator not being a registered charity. This constitutes misleading representation and appears to breach the Consumer Protection from Unfair Trading Regulations 2008 and the Charities Act 2011, which prohibit the false implication of charitable status.

– S

https://www.facebook.com/watch/?v=25241425045528851

Public clarification

Several claims in this post are inaccurate or unsupported. There is no independent evidence that Jayne’s Baby Bank is the “largest baby bank in Wales” or the UK’s “only dedicated Baby & Child Foodbank”. Many UK organisations provide food and baby essentials.

It is also a CIC, not a charity, and statements about being “entirely volunteer-run with no wages” require transparent confirmation via published accounts. Without evidence, these claims should be treated as promotional, not factual.

– S

https://www.facebook.com/groups/638417744708312/posts/1172710241279057/

Worth noting;

“I made the heartbreaking decision to step down from the trustee board solely to protect the charity. Sadly, the harassment continued. I have since involved the police and sought legal support. One individual is now on bail awaiting trial. The other has escalated further. I cannot say more at this time, as I fully intend to see justice through — but I will say this: I will never tolerate abuse, not towards me, my family, or our charity.”

– S

https://www.facebook.com/photo?fbid=848703851251035&set=a.107500218704739

PayPal explicitly distinguishes between personal payments, donations, and payments for goods or services under its UK User Agreement:

https://www.paypal.com/uk/legalhub/useragreement-full

PayPal confirms that fees apply to commercial transactions (goods and services). Personal payments, including voluntary contributions and donations where no goods or services are exchanged, are treated differently. Using the “Friends & Family” option is not, in itself, prohibited or fraudulent.

PayPal’s fees structure makes this distinction clear:

https://www.paypal.com/uk/webapps/mpp/paypal-fees

PayPal also expressly supports donations and fundraising via its platform:

https://www.paypal.com/uk/webapps/mpp/donations

Critically, PayPal’s Acceptable Use Policy identifies misconduct as misrepresentation or deception — not the avoidance of fees where no sale of goods or services has occurred: https://www.paypal.com/uk/legalhub/acceptableuse-full

In summary:

• Donations and personal payments are permitted on PayPal.

• Avoiding PayPal fees is not unlawful.

• A policy breach only arises if a payment for goods or services is deliberately misrepresented as a personal payment.

• Allegations of “fraud” require evidence of deception, not assumption.

Absent evidence that payments were for goods or services falsely classified to avoid fees, claims of fraud are inaccurate.

– Sherlock

https://www.paypal.com/paypalme/Jaynesbabybank

https://www.paypal.com/paypalme/Jaynesbabybank100

https://www.paypal.com/paypalme/jaynesbabybankrisca

The PayPal pages shown operate under multiple PayPal profiles and usernames, all presenting similar branding and descriptions associated with “Jayne’s Baby Bank”, “Free Food Bank”, and a “Charity Shop”, while stating that “100% of profits go towards the charity”.

PayPal’s UK User Agreement permits multiple accounts only where there is a legitimate and transparent purpose. Individuals are generally limited to one personal account, and businesses to one business account per legal entity. Additional accounts must represent clearly separate purposes or entities and must not be used to circumvent policies, scrutiny, or accountability: https://www.paypal.com/uk/legalhub/useragreement-full

PayPal’s Acceptable Use Policy further prohibits the use of multiple accounts to misrepresent activity, confuse payers, or obscure who is receiving funds: https://www.paypal.com/uk/legalhub/acceptableuse-full

In this case:

• Multiple PayPal accounts appear to be operated by the same individual.

• Each account uses similar charity or food bank branding.

• Statements such as “100% of profits go towards the charity” imply regulated charitable activity.

• PayPal approval does not confer charity status.

Where charity-related language is used, UK law requires that public representations are accurate and not misleading. Operating multiple payment accounts under similar charity branding, without clear disclosure of legal status, governance, or financial separation, raises legitimate transparency and consumer protection concerns.

PayPal permits donations and payments, but responsibility for lawful, accurate representation rests entirely with the account holder.

– Sherlock

Every attempt by this despicable woman to discredit other CIC’s and charities just brings more of her own deceitful scamming of donations into the public eye.

There was a time I thought she was brazen, but no, she is absolutely blind to the fact she is actually providing the evidence of her own downfall, that is one uneducated idiot.

And it also proves she is definitely stalking Hayley Thomas and HCT so it all adds up to another nail in her coffin!

Ive just watched the video, on Oh My Pasta, and have commented about her incredible philanthropy, ………

her rodent free pleasing shops, her excubrent praise for vulnerable adults, other charities, and pleasant demeana toward the general public, she is truly astounding, and all delivered with such pep and verve. Ive even eluded to the Nobel peace Prize. Or some other lofty weighty position, because she really does deserve it, So, heartwarming to see her, and to see poor Sammy doing so well, she didnt look terrified or anxious one bit, niether did she look exploited in any way, im sure.You just cannot keep a good woman down, go Jayne Carrie I hope you get everything you truly deserve!!

https://jaynesbabybank.co.uk/search/?search=%22Hayley+Thomas%22&limit=50&sort_order=newest&search_type=all&open_transcript=847644724690281_1766255795_fb.json

– S

Well Carrie Anne has got a very poor memory and absolutely no concept of time. She has stated that she was reported to Social Services by Hayley Thomas when she was a single mother in 2007 and that it somehow is linked to the Pastor at Oakdale Church. Strange that as he didn’t become a vicar until 2013. She is so jealous of Hayley Thomas and the success of HCT it’s unreal. I believe her livestream where she has absolutely decimated Hayley and her family has been sent to Gwent Police and the CIC commission. Enjoy your holiday Carrie Anne, it may be your last for a while.

Upon reviewing a recent transcript, one statement stood out:

“You know, and not paying any rent. Not wrong is it guys? We pay our rent.”

For public disclosure, it is important to note that Jayne’s Baby Bank has been behind on rent payments for several months on a particular property. January will be a critical month. We strongly recommend that the owed funds, starting from June, be paid to the landlord as soon as possible.

– Sherlock

Public notice (for transparency and safeguarding)

https://www.facebook.com/profile.php?id=100093714337967

This comment relates to material published on the secondary Facebook account titled “J’armarnis B Outique” (stated publicly as connected with Jayne’s Baby Bank).

For the avoidance of doubt: this is not a restatement of any allegations. Certain details are intentionally obfuscated/modified for legal, safeguarding, and data-protection reasons. The purpose of this comment is to create a clear, time-stamped public record that the content existed and raised serious concerns, in case it is later removed or reframed.

Concerns raised by the publicly posted material include:

Accountability request: If this page is associated with Jayne’s Baby Bank (directly or via linked individuals), a clear statement should be published confirming:

This is a public-interest transparency note intended to protect vulnerable people, uphold standards, and ensure that serious claims are handled through appropriate processes rather than social media commentary.

— Sherlock

Some quotes;

“Look off the Baptist Church in Oakdale.

Is that the one whose husband went to prison and got his priesthood degree in prison?

For smuggling drugs into the country.

Have I got the right church there?

I’ll have to go back and look at that.

But again, bizarre connection.

But there is definitely a church in Oakdale that the vicar got his vicar degree in prison while they were doing a massive stretch for drugs trafficking into the UK.

Not just bringing a couple of drugs over in his bag for personal use.

Drug trafficking.

Directly linked to the helping caring team.

And I’ve got, because I haven’t brought all my evidence out, right?

But I’ve got evidence going back that Hayley had links with this church and this vicar.”

You can read a backup transcript at; https://jaynesbabybank.co.uk/search/?search=%22Baptist+Church+in+Oakdale%22&limit=50&sort_order=relevance&search_type=all&open_transcript=NA_847088911441175.txt

– Sherlock

She’s not jealous at all is she. Disgusting behaviour from a Director of a CIC.

She’s basically accusing all charity shops who accept cash of dipping their hands in the till, and She’s witnessed it 100’s of times!!

I certainly don’t understand why she thinks HCT can’t sell received donations at their baby bank shop.

”a charity in the UK can sell donated goods, and this is a common and legitimate way to raise funds. The sale of purely donated goods is generally not considered “trading” for direct tax purposes, and the income is exempt from Corporation Tax, provided the profits are applied solely for the charity’s purposes.

I’m sure the HCT are fully aware of their obligations as charity and how their funds are used.

Shows Carrie’s truly vindictive, jealous nature to make such statements about other charities, who all seem to be doing far more for their local communities then she ever will.

https://www.facebook.com/watch/?v=1347616343239276

This Jayne sure looks like Carrie Anne.

– Sherlock

So this is her ITV interview!!

Looks more like Christmas night out with her staff and a quick online chat with the pasta people about her CIC.

Talk about bigging yourself up!

I know she supposedly suffers from dyscalculia but surely she knows the difference between 5, 4 and 3.

”We have 5 shops in Risca, Caerphilly, Pontypool and Pontllanfraith = 4

You actually have shops in Caerphilly, Risca and Pontypool = 3.

Pontllanfraith is a donation centre/ foodbank.

There have been indications of outstanding obligations at certain locations. Some narrative adjustment is expected in January.

— S

Jaynes Baby Bank are actively looking for a new property in Pontypool to replace the old one. I would advise future landlords to get the rent paid in full.

– S

Everyone in the interview seems to be smiling — unlike this group. Why is that?

– S

https://m.facebook.com/story.php?story_fbid=1741872355833199&id=100000313539647

– S

https://www.instagram.com/reel/DSAXRXhDLMN/

Congratulations to Mama to Mama on raising £20,000 for their Baby Bank.

Founded in March 2023 as a simple local call to action, Mama to Mama has grown into the first and only dedicated baby bank service in Thanet, Kent, responding directly to rising need during the cost of living crisis. Built around clear referral pathways, strong links with maternity, social and care professionals, and a focus on dignity and trust, the organisation supports families with children up to five years old while also prioritising wider family wellbeing.

What stands out is not scale, but structure and substance. With a modest social media presence of around 700 followers, Mama to Mama has focused on delivery rather than optics, embedding itself within local services, operating transparently, and earning recognition such as the Margate Mayor’s Community Award (2023). Their mission is clearly defined around three pillars: giving children the best start in life, empowering caregivers, and championing sustainability through circular living.

Mama to Mama demonstrates that a baby bank is not measured by online reach or inflated numbers, but by impact, governance, community integration, and trust. It is a practical example of how a baby bank should be run: needs-led, locally accountable, and focused on outcomes rather than attention.

– S

https://www.facebook.com/story.php?story_fbid=842174675237286&id=100083342834915

“Like I said – the council, the police, the fire brigade are sick and tired of the malicious complaints made against us -THEY are starting to tell us who has complained so we can make our own report to the police for harrassment and malicious complaints against us.”

Core factual position (UK)

Historical pattern evident from the transcripts

The transcript archive shows this claim is not new, but part of a long-running and repetitive narrative spanning several years:

Complaints are repeatedly characterised as fake, obsessive, bullying, or part of a coordinated attack, regardless of source or substance.

Over time, the alleged “complainants” change (other CICs, named individuals, volunteers, landlords, councils, environmental health, trading standards, the fire service, police, websites, Facebook users). The allegation remains constant: they are known, malicious, and being investigated.

Repeated assertions that councils “know who it is”, police are “investigating them”, complaints are “on record as malicious”, and SARs have revealed identities. These claims do not align with how SARs, council processes, or police investigations operate in practice.

Complaints are alternately described as ignored and laughed at by councils, then so serious they require months of investigation, and simultaneously harmless yet proof of criminal harassment. These positions cannot all be true at once.

Frequent warnings that complainants will be arrested, charged with wasting police time, exposed, or “come after”, despite no evidence of outcomes consistent with those threats.

Followers are urged to write to councils or police to “counteract” complaints, while also asserting authorities already know the truth — another internal inconsistency.

Repeated personal accusations, naming individuals, alleging conspiracies, and claims of council “data-mining” confirmations — none of which is credible under UK public-sector data controls.

Why the current claim matters

The latest statement — that multiple authorities are now identifying complainants so reports can be made against them — is simply the latest escalation of a narrative that appears repeatedly in the historical record.

What does not appear in the archive is any confirmed outcome consistent with the threats:

Plain conclusion

This is not an isolated misunderstanding. It is a recurring claim pattern that conflicts with UK law, data-protection rules, and standard regulatory practice, repeated over time without demonstrable legal resolution in support of it.

The assertion that councils, police, and the fire service are now routinely naming complainants is not credible, not lawful, and not supported by the transcript record.

– S

https://jaynesbabybank.co.uk/courtserve/

“Just to remind people we are trademarked. Breach of trademark is a criminal offence. We have noticed other baby banks and small businesses copying some of our ideas and intellectual property, and logos, social media content and videos. ”

Worth noting that this trade mark was registered while the entity was not a registered charity, and it still is not a registered charity. The mark itself is branded as a “Baby Bank & Charity Shop” and registered under Class 36 – charitable fundraising, which raises an obvious mismatch between branding, registration class, and legal status. A trade mark does not confer charitable status, exclusivity over community ideas, or immunity from scrutiny — and inaccurate claims around any of those are a separate issue entirely.

https://trademarks.ipo.gov.uk/ipo-tmcase/page/Results/1/UK00003910000

– S

A special night deserves something extra, so we have included material from an older Facebook account that has now been fully archived. This earlier profile contains content that directly contradicts later claims and provides independently verifiable timeline evidence.

Example post recovered from the archive:

Source:

jaynesbabybank.co.uk – archived transcript

Additional material included

Reveals the likely course type and includes the original name

Contradicts the later nursing/clinical training timeline

Matches the earlier account and predates the rebranding

Accurately dated workplace evidence from the pre-charity period

The time line does not add up. We have it all mapped.

– Sherlock

This Risdale woman couldn’t lie straight in bed (literally)

I did see I got a mention on one of her monotonous videos. Don’t know what I’m talking about? Don’t know which shops I’ve been to?

I’ll enlighten you Carrie, everything I’ve commented on is what you’ve put out in the public domain. Your own posts say when and what shops are open and what times. If you had the abundance of volunteers you claim to have, all premises would be open. I’ve only stepped inside ONE of the premises you RENT. The smell made me feel ill, there was probably more room to manoeuvre in a war zone.

I have actually witnessed you rummaging around charity bins, I looked at my dashcam and yes, my dashcam picked it up.

We all had a good laugh at you that morning in the coffee room at a nhs hospital. I didn’t keep the footage because you are insignificant to me and my colleagues. I work with people from all walks of life and who have worked at many hospitals. You are a LIAR, there’s not one person I know who has any recollection of you either training or working in our establishment. As for the ‘birdcage’, if I revealed how I know you have NEVER stepped inside the ‘hospital’ wing or pharmacy, would put my contact at risk.

There’s certain positions you don’t brag about. Protocol is EVERYTHING, and is definitely dangerous when you haven’t got a clue about keeping others safe.

I have also seen this woman rifling through the charity bins in Pontypool Tesco on a Sunday morning at 7.30am whilst walking my dog. This was when she was working/ sleeping at the Pontypool shop earlier this year. I contacted the Red Cross collection and they confirmed to me that she has no authority from them to take any of the donations.

Also in one of her latest livestreams she is now saying she’s a qualified teacher as well as a qualified nurse! Totally mind boggling!

Considering she is always saying that ‘her mothers’ are struggling with day to day living and Christmas, she is throwing it in their faces about her holiday to a 5 star hotel in Feurtaventura over Christmas which is probably costing her in excess of £4,000 for her and Daniel. If you’re wondering Carrie how I know, Google image is a wonderful tool. The Paradisus by Melia has great reviews, but I wonder what review you will give them? You’re not good at giving good reviews are you?

https://www.facebook.com/profile.php?id=100000313539647

Jayne Price sure does look like Carrie Anne!

– Sherlock

She has deleted the account after revealing her real name and historical profile. Rest assured, we have everything backed up.

– Sherlock

Public Notice: Concerning Conduct, Statements, and Materials Shared in Recent Videos

A recent video contains a handwritten letter, a demonstration involving a cheque, and an extended verbal monologue making a series of serious allegations against another charity and its trustees. These materials raise several significant concerns that are appropriate for public clarification.

1. The Handwritten Letter: Narrative Contradictions and Escalation

The video begins by showing a handwritten letter stating that the writer is responding to a letter alleging harassment, that there has been “harassment and malicious behaviour” for around 18 months, and that a “group of individuals” is conducting a hate campaign.

While the letter presents the writer as the target of hostility, this position contradicts the tone and content of the subsequent video, where the same speaker delivers threats, personal insults, allegations of criminal activity, and explicit warnings directed at named individuals and organisations.

This inconsistency is notable, as it suggests a shifting narrative depending on the intended audience. Publicly, the speaker adopts an aggressive and accusatory posture, whereas the letter frames them as a victim responding to harassment. Such contradictions are relevant for assessing credibility and motive.

2. Repeated Public Allegations of Criminal Conduct

Throughout the video, the speaker repeatedly asserts—presented as fact—that another charity and its trustees have committed fraud, deception, misuse of a charity number, hidden conflicts of interest, misled the council, and engaged in improper contracting.

No evidence is provided for these statements, and none of these allegations appear to come from official findings or regulatory determinations. Publishing unverified criminal accusations can cause serious reputational harm and carries legal consequences under defamation and malicious falsehood law. The frequency and certainty with which these accusations are made is cause for serious concern.

3. Threatening and Intimidating Behaviour

The transcript contains multiple explicit threats, including statements to the effect of having “all the time in the world to come after” the targeted individuals, intentions to “carry on disclosing information” about them, and warnings that if they say anything about the speaker, their family, or volunteers, they should “look out”.

The tone is hostile and confrontational, escalating a personal dispute into public intimidation. Such statements may reasonably be perceived as harassment, particularly when directed towards charity workers, volunteers, or family members.

4. Misrepresentation of Official Body Involvement

The speaker repeatedly implies confirmation or endorsement from official bodies, including the CIC Regulator, the Charity Commission, and a council department. The language suggests that complaints and “correlations” are on record and that these bodies have effectively confirmed concerns about the other charity.

However, no genuine regulatory findings are produced, and the statements are framed ambiguously. Misrepresenting the role or actions of official bodies can mislead the public and damage trust in regulatory processes.

5. Demonstration of Cheque Alteration and Fraud Scenarios

One of the video’s most concerning elements is a demonstration in which the speaker writes example cheques, explains how someone could allegedly misdirect donations, describes how fraudulent deposits might be carried out, and suggests that this is how another charity obtains money.

This is framed as something the targeted individual supposedly does, despite no evidence being presented. Beyond the defamatory implications, the video also publicly explains a method of cheque fraud, which is wholly inappropriate and could be misused by third parties. It also incorrectly suggests that cheque processing relies solely on handwritten names and would not trigger verification, which is not accurate in modern banking systems.

6. Personal Insults and Derogatory Language

The transcript includes personal insults, mocking remarks about appearance and clothing, and dismissive comments about individuals being “dull” or “a nobody”. This tone is inconsistent with legitimate safeguarding concerns or charity sector whistleblowing. It instead indicates a personal dispute escalating into hostile public communication.

7. Evidence of Long-Running Personal Conflict

The speaker refers to disputes going back several years, prior issues, and ongoing attention to the other charity’s actions and social media presence. This pattern suggests a sustained interpersonal conflict rather than a one-off disclosure of wrongdoing.

Such context matters when evaluating the intent behind public allegations and threats. The behaviour described and displayed in the video is more consistent with retaliation and escalation than with neutral reporting of concerns.

Summary

The combination of the handwritten letter, the cheque-demonstration images, and the two-part verbal transcript raises multiple public-interest concerns, including:

This commentary does not assert whether any of the underlying claims are true or false. It highlights the nature of what was said and shown, the risks associated with such public statements, and the impact such behaviour may have on individuals, volunteers, and charities operating in the community.

– S

Public Statement: Concerning Claims Made on the JBB CIC Facebook Page

The remarks in today’s video were published directly on the JBB CIC Facebook page, a platform that represents a registered Community Interest Company. This makes the tone, content, and accuracy of the statements even more significant, as they appear under the banner of an organisation that receives public trust and operates within a regulated framework.

Within the video, the speaker claims she “just drove past” and noticed the HCT charity van with a flat tyre, using this observation to reinforce a wider narrative of hostility towards the individual and organisation she routinely targets. Given the documented history of repeated posts, videos, and accusations directed at the same person, the likelihood that this was a coincidental, innocent passing-by is extremely low. Instead, the timing and presentation strongly suggest the claim was used to support an ongoing personal attack. Broadcasting this to followers from an official CIC page further amplifies the concern.

The video also includes questionable statements regarding the Welsh Assembly, referred to as the “period fraud squad” or “period pants fraud people”. These bodies do not exist under those names. The speaker claims that the Welsh Assembly has confirmed the identity of complainants, that councils have proactively contacted her regarding “malicious complaints”, and that subject access materials can be obtained simply by requesting them from this alleged fraud unit. These claims are highly unlikely to be accurate. Public bodies do not disclose complainant identities, do not operate informal “fraud squads” in this area, and do not release third-party subject access information on request.

The combination of misleading references to official bodies, statements that contradict established procedure, and an ongoing pattern of personalised attacks raises serious concerns about the reliability of the narrative being presented. When these claims are made on a CIC’s official social media page, they risk misleading the public, undermining trust, and misrepresenting how public institutions operate.

This public statement highlights the inaccuracies and implausibilities within the video, the inappropriate use of a CIC platform to target individuals, and the need for transparency when misleading or unverified claims are being shared in a community setting.

– S

HISTORICAL ACCOUNT OF CLAIMS MADE BY CARRIE-ANNE REGARDING BLOOD DISORDERS, TUMOURS, NURSING, DIAGNOSES, TRAINING AND MEDICAL HISTORY

(Compiled from long-term public statements and self-described timelines)

===========================================================

1. OVERVIEW OF KEY BIO CLAIMS

===========================================================

Her current Facebook bio states:

“I worked with Heamatolgy and that is how I discovered I had various blood disorders.”

Across earlier posts and videos, however, she has also claimed:

• That she discovered her blood disorders during student nursing placements on haematology wards.

• That she had been seriously unwell with a tumour and aplastic anaemia “since before 2015.”

• That the disorders were caused by a tumour that had been “left growing” after an MRI was allegedly shelved.

• That she spent “a week in the bird cadge at Cardiff Prison administering medication and treatments” as part of nursing training.

• That missing MRI records, sepsis, neutropenia, and a collapse episode each played a role in discovering or developing her conditions.

These accounts conflict significantly depending on the narrative being given.

===========================================================

2. INITIAL DISCOVERY CLAIMS

===========================================================

Across her public history, she gives multiple incompatible explanations for how she allegedly discovered her blood disorders, including:

• While working with haematology.

• During a student nursing placement.

• After locating a “missing” MRI in 2019.

• Following collapse, neutropenia and sepsis in 2020.

• As secondary to a long-standing untreated tumour.

Each of these timelines contradicts the others.

To read the full structured document – including detailed chronological contradictions across haemoglobin claims, tumour narratives, sepsis accounts, nursing qualifications, university pathways, safeguarding authority claims and palliative status statements – click here…

– S

The woman is off her head. I have noticed since her CIC announcement she really thinks she untouchable 😆 Carrie ann you are so nobody 🙄

https://jaynesbabybank.co.uk/wp-content/uploads/2025/12/JBB_Unpaid_Volunteers_Finance_Governance_Safeguarding_Claims_Analysis_2025.txt

– S

Today’s video about Tesco trolleys made me laugh. She has used trolleys for quite some time, wheeling them in and out the shops, filled with tat. Now claiming she collects the discarded trolleys and gets Dan to return them, to help Tesco has made her nose grow a few more inches.

She’s probably been approached about helping herself to other people’s property. The fact an employee could have raised the issue with their management will now be blamed on the ‘haters’.

Public Notice: Concerning Conduct and Misrepresentation in Today’s Facebook Post

Today’s Facebook post features an image of an official response letter relating to a Community Empowerment Fund grant, accompanied by a caption that states:

• “When I say fuck off and leave me alone – this is why people should listen.”

• “If you go out of your way to annoy me… it will come crashing down on your heads.”

• “Applying for a grant… knowing you had a volunteer… with links to the bus company… is fraud and deception.”

• “I think you will do well in prison – you are well liked.”

• “Last warning.”

This raises several serious concerns.

1. Misrepresentation of the Content of the Letter

The attached letter, dated 26th November 2025, confirms the following:

• The council received a complaint submitted by Ms Price.

• £1,700 was issued for two trips.

• Quotes were provided by two separate companies.

• The invoice was taken from “the cheapest provider.”

There is nothing in the letter that confirms wrongdoing, fraud, deception, conflicts of interest, undisclosed links, or misconduct by the charity named in the complaint. The document is entirely administrative and neutral. The Facebook caption, however, reframes it as if the council has verified criminal behaviour, which it has not. This is a clear mismatch between the evidence shown and the claims being asserted publicly.

2. Use of Explicit Threats and Coercive Language

The post includes direct threats such as “it will come crashing down on your heads” and “last warning,” which mirror the tone in today’s transcript. These are not the words of a neutral observer reporting a concern; they present as personal retaliation, using fear and intimidation while invoking the authority of the CIC’s public platform.

3. Definitive Criminal Accusations Without Evidence

Terms such as “fraud,” “deception,” and “prison” are stated as factual conclusions. The letter does not support these statements. Making such definitive claims about identifiable individuals or organisations without verified evidence poses clear reputational and legal risks.

4. Problematic Use of a CIC’s Public Page for Personal Disputes

The post is made under the official “Jayne’s Baby Bank” Facebook page, giving the appearance that a regulated CIC is issuing threats, making criminal allegations, and engaging in retaliatory attacks. Using organisational branding in this way undermines public trust, raises safeguarding concerns, and conflicts with expected standards of governance.

5. Escalation Pattern Between Transcript and Post

The language of the post aligns with today’s transcript, which includes similar statements such as:

• “you have committed fraud and deception”

• “I’ve got all the time in the world to come after you”

• “do you want me to carry on disclosing information… because I can”

• “that could send you to prison.”

This demonstrates a continuing and escalating pattern of hostile communication directed at specific individuals.

Summary

The letter published today is neutral and does not substantiate the accusations made alongside it. The accompanying statements are threatening, accusatory, and presented with the authority of a CIC’s public platform. This combination raises concerns about misrepresentation, governance, data protection, and the professional conduct expected of any community-facing organisation.

– S

Would love to know who she thinks has links to the bus company?

I put that grant paperwork in, I know how the system works.

She’s just mad cos no one will entertain the idea of giving her any grant money. Everything is accountable. Receipts, invoices, quotes, social media posts and excel spreadsheets are all needed to apply and monitor grant money.

Fking lost the plot, maybe she should give her head a wobble.

No one cares carrie. We just watch with the popcorn warming, waiting for you to crash down. How’s the customers and volunteers doing? Haven’t seen a few for a while.

She’s also not being entirely truthful/factual regarding the apparent grant she has received for sustainable period products.

CCBC from the Welsh Government Period Dignity Grant – secured funding to support families and young people in Caerphilly County to access free period products.

Schools, Non-Profit Organisations Charities and community organisations located within Caerphilly County can contact the Council and ask for free period product’s for their service users.

These include sustainable alternatives to single use period products which lessen the impact these product can have on the environment.

So realistically CAR has not received a grant from CCBC or any other local authority but has merely contacted CCBC and obtained some free period products.

Her posts recently have therefore been very misleading and not truthful regarding how she obtained these products.

No malicious intent is aimed in your direction but surely you can see it just makes you look bitter towards other organisations that have obtained grant funding for various projects, that you felt the need to portray that grants had been given to you for period products from the Council.

Therefore the email from Jamie Pritchard is correct in stating no grants or funding have been allocated to JBB.

Carrie, maybe before you go on record and state someone has a criminal record because they signed a community resolution order, please do some research.

Who is it issued by and how can I contact them?

Issued by the police

Does it involve guilt?

Yes – you have to make a clear and reliable admission.

Is it recorded on the Police National Computer (PNC)?

Yes (if it relates to a recordable offence). A facility is available on the PNC which allows an entry to be recorded which does not constitute a ‘criminal record’ but is accessible for police information.

Is it classed as a conviction?

No.

How long will it be on my record?

Although a community resolution order does not result in a criminal record, the information can still be used and taken into consideration if further offences are committed.

When does it become spent?

N/A

When do I have to declare it?

It isn’t a caution or a conviction, so isn’t formally covered by the Rehabilitation of Offenders Act 1974.

Is it disclosed on DBS checks?

Not on a standard check.

It might be disclosed as part of an enhanced check in the ‘relevant information’ section, i.e. the offence has a bearing on the kind of work you are applying for. However, in our experience it is rare for community resolution orders to be disclosed in the ‘other relevant information’ section.

Other information

A ‘community resolution’ resolves a minor offence or anti-social behaviour incident through informal agreement between the parties involved, as opposed to progression through the traditional criminal justice process.

It is primarily aimed at first time offenders where:-

there has been an admission of guilt

the victims views have been taken into account

Community resolution allows police officers to make decisions about how to deal more proportionately with low-level crime.

A little research goes a long way.

A think an apology may be required!!

She should know this as she has one for harassing me.

Now why doesn’t that surprise me.

Deflection is her defense mechanism where she shifts the blame from herself to anyone who speaks out.

Her world is getting smaller and smaller and the more we get the truth out there, the stronger we become. Justice will prevail.

This as got to be a criminal offence and comes under harassment right?

This type of post can fall within harassment or malicious communications law, depending on the wider pattern of behaviour. UK legislation looks at repeated unwanted contact, threats, and public accusations that cause alarm or distress.

Statements such as “last warning,” threats of consequences, and unsupported criminal allegations made about identifiable individuals are the kind of conduct these laws were created to address.

Whether it is a criminal offence can only be decided by the police or a court, but the content is within the scope of what is normally reported as potential harassment.

Anyone affected should keep evidence and seek advice from the police or relevant regulators.

– S

PUBLIC REBUTTAL & EVIDENCE ANALYSIS

Before reading this, the public and any investigating authorities should consult the searchable transcript archive, which contains thousands of primary-source statements made by Jayne herself across Facebook posts, videos, comments and livestreams. Every contradiction below is sourced directly from her own words.

https://jaynesbabybank.co.uk/search

1. Repeated False Claims About a “FREE” Food Bank

Across dozens of recent posts and videos Jayne loudly insists that:

However, the transcript archive shows a consistent, long-term pattern of restricting access to the supposed free services only to paying shoppers:

This directly contradicts her public narrative. A food bank is not free if it requires you to spend money in her shop to access it. The repeated use of the phrase “customers and donators” (over 90 times on record) proves this is a commercial loyalty scheme masquerading as a food bank.

2. Selling Food While Accusing Others of Charging

Jayne regularly attacks legitimate pantries and food hubs for charging £3–£4 for donated food. She calls this “unethical” and claims they should be “investigated”. But her own transcripts show:

This is the same behaviour she accuses others of. The public deserves clarity: these are sales, not free foodbank services. Some are bundled with “free foodbank items”, which is the very practice she condemns elsewhere.

3. Misleading Claims About Council and Regulatory Approval

Jayne repeatedly claims:

These statements are misleading. Councils do not register foodbanks. The Financial Conduct Authority does not regulate foodbanks or baby banks. CICs are regulated by the CIC Regulator and Companies House – neither of which appear in her claims.

Her wording conflates being “known” to a council with being “regulated” by one, which misrepresents authority and oversight.

4. Contradictions on Charging and Donations

She states:

Yet multiple posts confirm the opposite:

This shows a pattern of inconsistent messaging: one day items are “free”, the next they are “£1 minimum donation”, the next they are “not for sale”, and the next they are “available for £1”.

5. The “Customers and Donators” Gatekeeping Rule

This phrase appears more than 99 times in the searchable transcript archive. It is the cornerstone verifying the contradiction:

A foodbank is not “free” if the price of admission is shopping in her commercial retail outlet. This is not a charitable model; it is a pay-to-access scheme.

6. Contradictions Regarding Social Services Referrals

Jayne often claims:

However, her own videos show she uses this claim to discredit legitimate foodbanks and pantries, creating fear among vulnerable mothers. This is a safeguarding concern. Accredited foodbanks have strict duty-of-care obligations, and her claim of avoiding referrals contradicts best practice guidance supplied by councils and safeguarding bodies.

7. Misuse of the Term “Registered”

Jayne frequently states she is “registered” with councils, the FCA, the foodbank network, or other bodies. This wording implies formal recognition, oversight or legal status which does not exist. The public should be aware that:

8. Commercial Activity Presented as Charity Work

Jayne repeatedly advertises:

Yet she simultaneously insists:

The inconsistency between these two narratives is evident. Commercial retail activity is being marketed as charitable provision, which misleads the public, donors, and vulnerable service users.

9. The Pattern: A Loyalty Scheme, Not a Food Bank

Based on the transcript evidence, Jayne’s operation functions as follows:

This model is not equivalent to a foodbank, does not match UK foodbank standards, and contradicts how she publicly describes it.

10. Conclusion for the Public and Authorities

The transcript archive, which the public can search freely using the link above, shows a clear pattern:

The public is encouraged to check the primary-source evidence themselves. Nothing stated here is speculation; it is all quoted directly from her hundreds of recorded posts and videos.

Search the transcript engine:

https://jaynesbabybank.co.uk/search

– Sherlock

Secondary Comment: The “It Doesn’t Say Baby Bank on the Sign” Claim

Before reading further, please verify everything independently using our public transcript archive:

https://jaynesbabybank.co.uk/search

In a recent transcript, Jayne stated:

This is yet another example of a shifting narrative that collapses under its own documentation. The wording on a single shop sign is irrelevant when every official, legal, public, and promotional channel she controls is explicitly branded as a Baby Bank.

Most importantly, according to the official Companies House incorporation:

This is the legal name she chose.

The legal name she filed.

The legal name she is now bound by.

To then argue that a shopfront sign “doesn’t say baby bank” is meaningless when:

Everything she publishes, every livestream, every appeal, every poster, every receipt, and now her own CIC paperwork all confirm the same identity: She trades and presents as a Baby Bank.

The only time this changes is when she is challenged — then the narrative suddenly shifts to whatever is most convenient in that moment. This “it’s not on the sign” line is simply another attempt to distance herself from the consequences of the branding she actively uses everywhere else.

The public record is clear, and searchable in full. The inconsistency is her own.

– Sherlock

“so jealous.

Now look at this, Daniel said, how distasteful is that?

A suicide vest with babies on.

This is the type of caliber of people who are dealing with, like, I just go to the comments now.”

Reference image: https://jaynesbabybank.co.uk/2025/10/08/jaynes-baby-banks-facebook-faq-vs-the-official-record/

It’s a suit of armour – or, as those of us with a brain call it, a metaphor. Now, who is it that likes to use children as a shield from criticism? Have a proper think.

– S

Public Disclosure: Concerns Regarding the “CIC Complaint Letter” and Associated Claims

The video segment discussing the alleged CIC complaint contains several inaccuracies and raises legitimate public concerns. The statements made about the complaint process, the regulator, and the individuals allegedly involved do not align with how Community Interest Company oversight operates in the UK.

Firstly, the claim that a complaint would result in the Charity Commission “shutting down” the operation is incorrect. The organisation is not a registered charity and therefore does not fall under the Charity Commission’s jurisdiction. Complaints relating to a CIC are handled by the CIC Regulator, and the regulator does not suspend or shut down operations simply because a complaint has been filed.

The video also asserts that the regulator “told us who it was straight away” and provided a copy of the complaint naming individuals. This is highly unlikely. UK regulators do not disclose complainant identities for safeguarding and fairness reasons. If such information has been disclosed publicly in the video, it raises serious concerns about how official correspondence is being handled and whether personal data has been misused.

It is also notable that the video repeats a series of accusations against named individuals and presents them as fact, despite offering no evidence. Using an alleged complaint letter to bolster personal grievances, or to frame critics as malicious, is inappropriate and undermines the expected conduct of a CIC director. Directors are legally required to act responsibly, maintain transparency, and avoid behaviour that damages public trust.

Furthermore, the transcript shows a pattern of conflicting statements: references to “trustees” despite the organisation not being a charity; suggestions of ongoing police action with no substantiation; and claims that all complaints come from the same “group” without proof. This behaviour, combined with the on-camera display of official correspondence, paints a troubling picture of misunderstanding, exaggeration, and misrepresentation of regulatory processes.

In summary, the claims made about the complaint, the regulator, and the individuals involved are inconsistent with UK law and standard CIC oversight. The handling of the letter and the public commentary surrounding it raise clear questions about governance, accuracy, and the responsible management of a community organisation.

– S

Asking for a friend. What exactly are the police going to do about a letter of complaint, are they going to start knocking on the complaints doors and arrest them??? I don’t think so

Complaints have gone through correct channels and from what I can see on the letter on her video they have probably submitted the evidence to corroborate them.

Miss Ridsdale is using intimidation to stop anyone who does complain by stating C.I.C. or other governing bodies will automatically tell her the name of the reporter and this in turn will go to police as evidence. This is all false and inaccurate and is only being used as said to intimidate people not to complain for fear of being in trouble.

I for one if I feel a complaint is warranted than I will do and I will ensure I have the evidence to corroborate my complaint.

Important Notice to Police and Public: Verified Evidence Contradicts Her Claims

The repeated claims about “police calls”, “councils chasing up websites”, and vague threats of people being “included in investigations” do not withstand scrutiny. These statements are not supported by any verified facts. They follow the same established pattern witnessed across historic livestreams and deleted posts: inflated claims of authority, accusations against innocent parties, and narratives later contradicted by councils, governing bodies, and even her own revised posts.

The suggestion that unnamed trustees in other organisations are stepping down because of her is another fabricated claim. There is no evidence linking those decisions to her behaviour. This fits the long-running cycle: she places herself at the centre of unrelated events, reframes normal organisational changes as personal victories, and attempts to elevate her perceived importance through invention rather than fact.

Her warnings that the police can “download deleted conversations”, that anyone “remotely involved” will be “included”, or that councils “act on her reports” are empty and legally meaningless. These are performative threats used to intimidate, not inform. Police do not act on Facebook allegations, and councils do not investigate fantasies presented as fact.

Even her own admissions now reveal that councils have received complaints about period-product grants, undercutting her claim that all scrutiny is malicious or conspiratorial. This follows the same sequence documented between 2022 and 2025: deny, attack, claim persecution, then quietly acknowledge the substance once confronted with evidence.

For clarity: every relevant piece of information has been preserved — deleted livestreams, contradictory statements, shifting stories, historic TikTok claims, Facebook variations of the Kettle pages, and the numerous posts she later edits or removes. The archive remains openly accessible at this link. The referenced video also remains accessible: Facebook link.

Definitions relevant to her behaviour

Projection: Attributing one’s own actions, motives, or misconduct to others. For example, accusing others of harassment or dishonesty while engaging in those behaviours herself.

Narcissist: A person who consistently displays entitlement, inflated self-importance, defensiveness, and an inability to accept accountability. This includes rewriting narratives, attacking anyone who questions them, and casting themselves as the perpetual victim.

Illusions of grandeur: False beliefs of having special status, authority, or influence. Examples include claiming she caused trustees to resign, declaring that councils and police act on her demands, or inserting herself into decisions made by entirely unrelated organisations.

To police officers and members of the public reading this

We strongly encourage you to visit our website and read the articles. Every claim is supported by verifiable evidence: official responses from teaching associations, statements from councils, governing body documentation, Companies House filings, period-grant criteria, and archived livestreams. These sources directly refute the stories she continues to promote. This is not opinion or speculation — it is open-source fact.

Her narratives consistently collapse when measured against official records. Claims of professional qualifications have been denied by the bodies she cites. Assertions of charity status are contradicted by Companies House. Alleged council support has been disproven by councils themselves. Each contradiction is documented, timestamped, and archived.

We expressly welcome police to use our website and archives. We want the accountability process to be fully informed. Every deleted video, contradictory statement, historic message, and piece of evidence from 2022–2025 has been retained, precisely because her narrative shifts frequently, but the record does not.

There is no conspiracy. There is no coordinated attack. There is no harassment. There is only public documentation, official information, and evidence anyone can check. Her qualifications are as false as her eyelashes — and unlike her threats, the facts are permanent.

– S

So her trip to the hospital today was for her scan?????

Has it shrunk? Ms Risdale, how can something ‘shrink’ when you’re not being treated for it. Have you ever been around a person having treatment for what ailments you claim to have? Let me tell you, whether its hospital based or home medication, you will NOT be doing what you do.

Also no shops open until midday? Where is your army of volunteers? The ones who you claim, must have a DBS check…. Your little empire is falling, it can’t come quick enough for people who have the conditions you speak of.

You are a FRAUDSTER, your arrogance and rudeness knows no boundaries.

When assessing her historic statements, a consistent pattern emerges: every genuine medical clue she provides points to a benign uterine fibroid, not a malignant tumour. The terminology used in her public posts is misleading, medically inconsistent, and frequently exaggerated. Below is a clear summary of the evidence.

Why the evidence strongly indicates a fibroid:

Conclusion:

All available evidence from her own posts — the specific treatments described, the imaging language, the size changes, the long gaps without intervention, and the total absence of cancer-based care — aligns with a uterine fibroid. The repeated portrayal of this as a life-threatening tumour causing multi-organ damage is not supported by any documented medical evidence. This fits the broader pattern of embellishment and inconsistent health claims often seen across her public content.

– S

When any person suffers from the illnesses she claims to have, people have sympathy. I have suffered a benign tumour, it wasn’t going to kill me until it started growing at an alarming rate after suffering a fall. It had to be removed because it started affecting other organs.

This was over 20 years ago.

It infuriates me when she attempts to gain sympathy whilst making a total fool of herself.

The only stomach problem she has is probably indigestion from an overactive knife and fork. Her eating habits are a death sentence in itself, especially as she claims to be diabetic.

SOURCE: https://jaynesbabybank.co.uk/search/?search=%22cancer%22&limit=50&sort_order=oldest&search_type=all&open_transcript=153290447459049_1671793789_fb.json

This is what happens when the story is stretched too far. If you publicly claim to have “a massive tumour and aplastic anaemia, which is a rare blood and bone marrow cancer”, people will naturally scrutinise it. In reality, it appears far more likely she received a transfusion for severe iron deficiency caused by a fibroid.

EDIT:

SOURCE: https://facebook.com/story.php?story_fbid=829970939790993&id=100083342834915

The numbers you’ve shared don’t support the claim of the need for a bone marrow transplant. A haemoglobin of 115 g/L is only mildly low, and a drop to 94 g/L still falls within the range of moderate iron-deficiency anaemia, which is extremely common in women with heavy bleeding from fibroids. Even the previous level you mentioned — 61–63 g/L — is severe anaemia but is typically caused by blood loss, not bone marrow failure.

All of these values fit the pattern of iron deficiency from chronic bleeding, not a rare marrow cancer. None of the readings you’ve shared would prompt a discussion about a bone marrow transplant, and slower clotting at a cannula site is consistent with low haemoglobin, not aplastic anaemia.

The figures point firmly towards anaemia secondary to a fibroid, rather than any form of bone marrow shutdown.

– S

Maybe her shops will be closed for the remainder of the week…….

She’s going to be so tired after having treatment, back and forth hospital etc is very draining and she will need to rest.

After all, these are serious health issues, that will need immediate attention.

I myself suffered with fibroids for years and was told by GP were I was living when I hit menopause they would naturally shrink. They didn’t

In the end I had one size of a watermelon with another one growing on top as well a few others.

The only treatment left was either to cut the stem of blood flow which was no guarantee or have full hysterectomy and opted for the big one. That wasn’t pleasant but it changed my life.

Prior to surgery I was very limited on what I could do or go during certain times of month. Not going into details lol

But I have said from day on she has fibroids as no GP or hospital would leave anyone that long if the had a cancerous tumour.

As stated all the above treatments are there to help fibroids not tumours and if they shrinking that means treatment is working as it should.

When people lie and over exaggerated what they have it is for attention but I think it is disgusting to claim you have cancer when you don’t and any individual that does that needs to take a hard long look at themselves in the mirror. Ms Ridsdale is a pathological liar and she wouldn’t know the truth if it was right in front of her.

The problem about being a liar is you have a good memory to remember all the lies they spin but when caught out everything said will be up scrutiny.

Also doesn’t Miss Ridsdale know there are plenty of woman who have been through and going through the same problems and will know she is telling lies

P.S I only said last night to someone she has fibroids not a tumour.. getting good at calling her out lol

Ms Risdale doesn’t seem to have the capability of thinking other people have had serious health issues and will compare diagnosis and treatment.

The woman deluded.

Post from 2022:

”After a recent MRI, I am still in the palliative category – most of you know that I have a massive tumor and aplastic anemia which is a rare blood and bone marrow cancer”.

Post from today whereby you deny the above:

”Well, apparently now I’ve got bone marrow cancer!

You’ve got fibroids and you’ve got bone marrow cancer”.

Carrie it’s not malicious communication if its factual.

You yourself have said on numerous occasions you have bone marrow cancer.

Also for a civil conspiracy law suit to commence you have to prove that all of us on here know each and/other and have a written signed agreement in place between all of us.

Thereby your case is null and void before the ink is even dry on the paper.

LIVE: https://m.facebook.com/story.php?story_fbid=153290447459049&id=100083342834915

Backup: https://archive.is/Ap1aQ

She still has not deleted the status.

“After a recent MRI, I am still in the palliative category – most of you know that I have a massive tumor and aplastic anemia which is a rare blood and bone marrow cancer.

I think I’m going to have to bite the bullet and get a cleaner 😕 for the house and the Risca shop.

Can I have some names of good cleaning firms guys – thanks

I need a cleaner that will turn up the exact time and day we ask please”

– S

People are victimising her?????

So she doesn’t victimise anyone Miss Ridsdale thinks she holier than though.

Let me see oh yes I found a post from someone called Peter Mal in Caerphillys online boot sale FB page in regards to HCT opening a Baby Bank- Go and smash it the bag HCT

“Another embarrassment for HCT this week. They can’t even come up with their own concept – they have to steal other peoples 🙈“

Approx 3 hours later Miss Ridsdale posts on JBB a passive aggressive comment about them and how the will take strain of her.

Scrolled down to Oct and there is another post about Hayley-

These are the only 2 posts from Peter Mal honestly does not take genius this is Miss Ridsdale and she has the audacity to say she is be victimised.

I for one are not victimising you and speaking only the truth and facts.

What a joke!!!!!

Peter Mal is Carrie. That account has been around since 2020 and has been linked to various names she used at the time.

– S

everyone needs to report her til something is done there’s enough evidence on her page for criminal cases for fraud harassment fake illnesses the list goes on

Ceriann Risdale, Jody Williams, Baby Bank Price, Jodie JD Jones, Joan Payne, Darwin Morris, Jade Freecycle, Baby Bank and Friends, Jaynebaby Bank, Jayne Price, Cerys Williams, Carrie Price, Jayne Louise Price, David Jones and Peter Mal. These are some suspected aliases she has used the past five years on Facebook. Some accounts remain some do not.

S

So she says and claims “everyone’s on benefits” as an insult – when they actually work unlike her, she’s the one on benefits and has a pip car? Make it make sense

How else is she affording to live? if she isn’t on benefits then has she just proven she is cashing in baby bank donations. How else do you get money? You’re the one on benefits CARRIE you also have a free car while you run around lifting heavy boxes working on your feet selling crap all day to the public who don’t want it but claim your too ill to work to the benefit people no one else ..

I see Carrie has received a letter from the CIC Commission with a complaint about her behaviour as a director of a CIC and she straight away blames Hayley Thomas. I know for certain they have received numerous complaints from numerous people that are in no way connected to Hayley Thomas or HCT. Yet again she states that she has been given details by the CIC Commision of every person that has made complaints. This would not happen. Hopefully they will continue to investigate her and finally put an end to the misery she causes to so many people.

She appears to disregard GDPR entirely, as well as the clear, fully disclosed emails presented here, contrasted with her unsteady voice and carefully framed camera work. In her video she claims she has not yet applied for a charity number, yet she previously changed her profile to “charity organisation” while showcasing supposed charity-shop items on a livestream, including the headboard. Pathological liars should at least attempt to maintain a memory better than that of a goldfish.

– S

I do not know anyone who posts on here. My complaints to relevant authorities are my own observations of years of seeing what she’s putting on public forums.

The scale of her deception claiming how ‘ill’ she is, her abundance of donations (where are they coming from) outweigh many legitimate charities put together, her hatred towards genuine people, the venomous way she speaks publicly, and her treatment to previous volunteers, opened my eyes.

I am extremely grateful for Sherlock and every other person who continues to ‘out’ this fraudulent woman.

She is obsessed with this forum, yet continues with her total contempt for authority.

Toggle, obviously isn’t my name, should she ever need to know who i am ,she will discover we have never met. I have never donated to her scam business. I’m merely a person who knows right from wrong.

There is a twist of irony in today’s circulating post. Jayne’s Baby Bank published the following claim:

This is notable because JBB routinely asserts that Caerphilly County Borough Council support and fund the organisation with grants. Yet the official position from the council directly contradicts those repeated claims. For transparency, the relevant correspondence is shown below:

The Leader of the Council, Cllr James Pritchard, confirms unequivocally:

“Jayne’s Baby Bank isn’t regulated by CCBC, and we have not funded the organisation.”

In simple terms:

This makes the original Facebook accusation particularly ironic: criticising a fictional misuse of council grants while simultaneously promoting the long-standing narrative that JBB itself receives council grants. The verified email shows that no such funding has ever existed.

Consistency matters, especially when public claims are used to imply legitimacy, authority, or official backing that does not exist.

Signed,

Sherlock

SOURCE: https://www.facebook.com/story.php?story_fbid=830574429730644&id=100083342834915

This claim is incorrect when compared with the documented evidence.

The payment shown in the screenshot is a **historic £1,000 foodbank payment from Pontypool Community Council dated 19 December 2024**, not current support and not from Caerphilly.

More importantly, **Caerphilly County Borough Council has confirmed in writing** that:

– Jayne’s Baby Bank is **not regulated by CCBC**

– CCBC has **not funded** the organisation

– The only oversight is standard **Trading Standards** obligations applicable to any high-street operation

There is therefore **no evidence of any council funding “again this year”**, and using an old payment from a different council to imply current support is misleading.

PAGE 6: https://jaynesbabybank.co.uk/wp-content/uploads/2025/03/Finance-Governance-Policy-Agenda-Feb-2025.pdf

– Sherlock

If you look at the photo she has doctored it to fit a narrative. It’s is ‘whiteed’ out. You can see the pixelation.

https://29a.ch/photo-forensics/#level-sweep

Useful tool: https://jaynesbabybank.co.uk/wp-content/uploads/2025/11/Sweep.png

– S

Congratulations to HCT on Their Civic Award

A well-deserved congratulations to everyone at HCT for receiving a Civic Award at the Blackwood Miners’ Town Council ceremony. Recognition of this kind reflects genuine commitment, consistency, and the hard work carried out by their volunteers.

Janet, Sarah Browne, Ann Peebles and Angela Davies represented the organisation at the event, accepting the award on behalf of the whole team. It is encouraging to see community-focused work acknowledged in a formal setting, and this award highlights the ongoing effort HCT puts into supporting others.

Well done to everyone involved.

Source: https://www.facebook.com/groups/638417744708312/posts/1154161636467251/

– S

Congratulations HCT well deserved for the hard work you all do🎉🎉👏👏

– S

Not only is she not a charity shop as highlighted previously on this page but, she decides to block, an already narrow pavement with a trip hazard (has she not done a health & safety course). Can you imagine the claim she would receive if that fell on someone or they tripped over it. Totally clueless. Her shops are a total **** tip and the pavement outside her shop also, now she has to blight the main road through Caerphilly as well.

She has no shame

Carrie I don’t know who the hell you think you are but you are now telling a vulnerable adult that – you are going to ring physio for me as I can’t seem to manage to circumnavigate around any f***ing where by the look of it – and that I need more training on how to rewalk around the place –

I’m disabled for goodness sake, I have severe arthritis in the spine and hip and struggle daily with mobility. Who the hell do you think you are, you are seriously one sick and twisted individual.

Is this really how the director of a CIC acts online. Your supposed to be working for the community of Caerphilly and that involves people from all walks of life, including people with disabilities.

Its like you saying a blind person (who could have walked into that headboard) should learn how to see again!!!

You have the gall to laugh as well when saying all of this – maybe you should be locked away in a padded cell for the rest of your life, so we don’t have to listen to the sound of your boring monotonous voice any more.

By the way I’ve only ever reported you to health and safety and they have been extremely helpful. They keep me updated regularly. You make out on your lives that your stopping donations until after Xmas because you need to reduce your stock. Why not tell the truth to your followers and customers. You had two notices given to you by CCBC because of the state of your shop, customers cannot navigate freely around them and you had to reduce your stock. Not your choice to do this but you were told to or else further notices would be forthcoming. You were also told not to move stock from one shop to another or bring in stock from your donation centre or anywhere else – you’ve definitely failed to comply with this. When will you learn you have to comply with rules and regulations, otherwise it will literally all come crashing down on top of you.

Well your arthritis can’t be that bad Liz if you can manage to be on the phone complaining all day and managed to get to Pontypool shop, walk from the car park or down the hill from tesco and manage to walk around the 17 rooms of Pontypool shop. Have you updated pip that your mobility is much better. Catch you anywhere near the shops again you can look out.

This account belongs to Carrie (Jayne) posting under her alias David Jones, BTW.

https://facebook.com/story.php?story_fbid=828253129962774&id=100083342834915

Sherlock

What has having arthritis got to do with emailing H&S once. They then called me 3 times to update me.

You really need to get your facts right before slating people, who has said I claim PIP? I don’t need to my darling devoted husband earns enough to care for me.

Making threats as well now are we? What do I have to look out for – all the rubbish you’ve accumulated 😄.

Also I’m sure H&S would be really interested to hear about your little hideaway in Rudry.

Truth hurts doesn’t it Carrie, karma is a bitch as you keep saying.

Your new mantra as a CIC should be ‘Do unto others as you would have them do unto you”. If your not prepared to be nice to people, show respect, kindness and compassion, then unfortunately no-one is going to be kind to you.

Pot kettle comes to mind Miss Ridsdale aka David Jones.

Maybe you should have look should take a long look in the mirror before making comments

Very threatening behaviour for some claiming to by a man on a woman.

Hopefully they will take your words of advise and report you for your threatening behaviour towards a vulnerable woman as they will be covered under the same law you spout on about